The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. The residential home must be rented under a legal tenancy agreement between the owner and the tenant.

Gst On Rent Applicability Tax Rate Calculation And Payment Explained

The legalese gets complicated so lets break down what this.

. From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of income tax. Rental income received by Malaysian resident individuals not exceeding RM2000 per month for each residential home. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

The first 1000 of your income from property rental is tax-free. This was introduced in Section 4d of the Income Tax Act 1967 ITA. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

50 tax exemption will be granted on rental income not exceeding RM2000 a month on. Who are not New Zealand residents but earn rental income from their New Zealand properties. 1 Marginal tax rates on the net rental income after expenses 2 Flat 10 tax on the gross rental income before expenses 3 Tax exempt route on small incomes.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Rental income received not exceeding RM2000 per month for each residential home. A landlord can choose any of the following three tax routes.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Income from house property. Who pays tax on rental income.

Tax exemption is given for a maximum period of 3 consecutive years of assessment. Reporting rental income on your tax return. Have overseas residential property.

If the rent of property is Rs 15000 per month meaning GAV is Rs 180000 1500012 you do not need to pay rental income tax. Most people who earn rental income will pay income tax on it. To encourage Malaysian resident individuals to rent out residential s at home reasonable charges it is propd that 50 incomose e tax exemption be given on rental income received by Malaysian resident individuals subject to the following conditions.

However this is the case only when one house is bought posing a problem to people who sold an ancestral home and split the proceeds among family members. Section 54 of the Income Tax Act stipulates capital gains from residential real estate are exempt if used for buying another house. Tax Exemption for Tenancy with Monthly Rent Not Exceeding RM2000 Formalised for YA 2018 28 February 2019 On 27 October 2017 the then Finance Minister announced during his 2018 Malaysian Budget Speech that in order to promote the rental of residential homes the Government will grant a 50 tax exemption on rental income not exceeding RM200000 per.

Changes to tax relief for residential property. The source code to be used on the income tax return for a rental profit is 4210 and is 4211 for a rental loss. In this case you have to pay tax on your rented property because the GAV of a property is Rs 360000 which is higher than Rs 250000.

You need to pay tax on rental income in the year its earned. Contact HMRC if your income from property rental is between 1000 and 2500 a year. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis.

This includes people who. The grounds including all buildings are less than 5000 square metres just over an acre in total. This means you get to deduct the expenses arising from your rental activity.

This is your property allowance. Rental income and expense deductions. Tax Exemption on Rental Income from Residential Homes Received by Malaysian Resident Individuals 50 income tax exemption be given on rental income received by Malaysian resident individuals for a maximum period of 3 consecutive years of assessment subject to the following conditions.

The total expenses to be set off against rental income amounts to R38 027. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. If all these apply you will automatically get a.

Typically the rental income tax forms youll use to report your rental income include. The difference between the rental income and the expenses is taxable income in this case R11 973 R50 000 less R38 027. The criteria to qualify for this tax exemption are.

The exemption is not restricted to just one residential property but as many properties as the individual owns. You did not buy it just to make a gain. The recent ruling by the Mumbai bench of the Income Tax Appellate Tribunal ITAT which clearly states that tax on rental income is only applicable when the rent is actually received will have a direct bearing on all cases where tenants have not been able to pay the rent because of the ongoing Coronavirus-induced economic stress amid a sharp fall in employment numbers.

The Income Tax Act of India has a specific head of income titled Income from house property to tax the rent received by an owner of a property. Rental income received does not exceed. Are joint owners of a rental property.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax.

Hra Tax Exemption How To Save Tax On House Rent Allowance

Rental Income Tax Rental Income Real Estate Rentals Income Tax

Tax Consequences Of Owning A House In The Netherlands Expatax

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Your Assessment Notice And Tax Bill Cook County Assessor S Office Assessment Revenue Office Tax

Hra Exemption Pan Number Of Landlord Smart Paisa

Monthly Rental Income Tax Ronalds Llp

There Are Many Deduction Opportunities For Hosts But They Might Not All Be Obvious So It Pays To Do A Little Research Vacation Rental Host Rustic Country Home

Where Quality Meets With Affordability Real Estate Affordable Housing Construction

How To Legally Rent Your Home For Tax Deductible Business Purposes The Bottom Line Cpa

Gst On Rent Does Rental Income Attract Gst Taxgyata

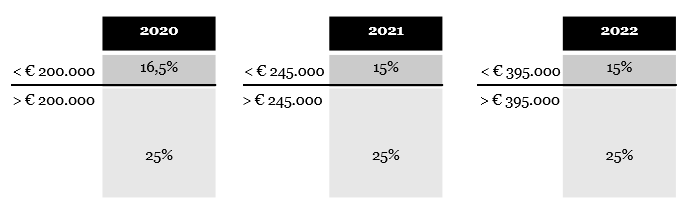

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

How To Save Tax On Rental Income In India Tax Deductions On Rent

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Dutch Housing Update New Rules In 2022 And A New Minister Dutchnews Nl

Affordability And Livability Is In Our Hands Build Blog

We Believe Knowledge Is In Fact Empowering These Mistakes Are Avoidable At Homesindia Our Number One Priority Is To Help Rental Income Investing Real Estate

Property Tax In The Netherlands